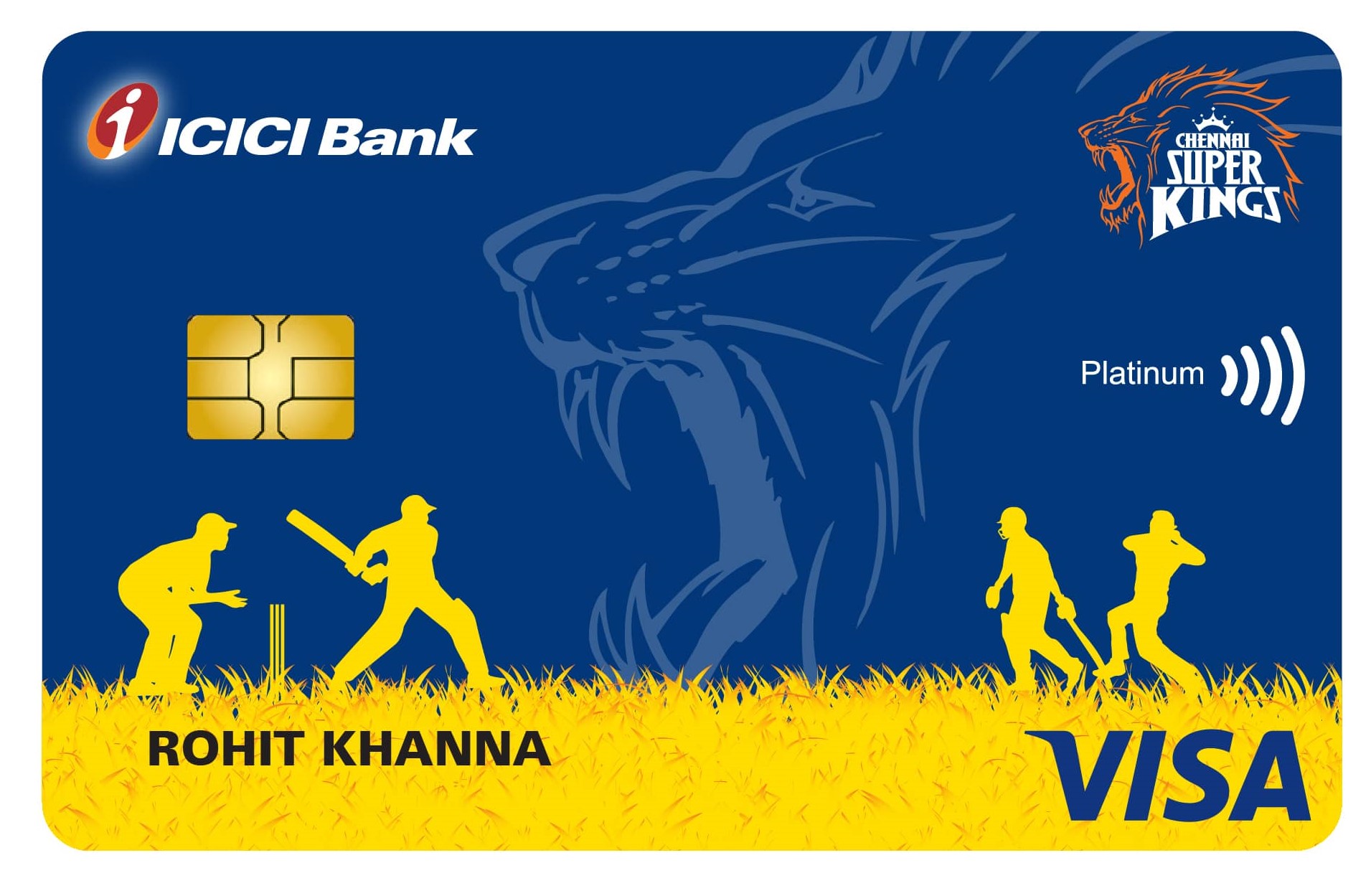

ICICI Bank partners with Chennai Super Kings to offer CSK fans a benefit-packed co-branded credit card

Chennai Super Kings ICICI Bank Credit Card has been specially designed with a range of exclusive privileges for millions of cricket fans of the iconic team.

ICICI Bank on Wednesday announced that it has launched a co-branded credit card in partnership with Chennai Super Kings (CSK), one of the most successful cricket teams in India.

Named ‘Chennai Super Kings ICICI Bank Credit Card’, the card has been specially designed with a range of exclusive privileges for millions of cricket fans of the iconic team.

The new card is another addition to an exclusive set of co-branded credit cards offered by the Bank to enable sports enthusiasts to connect with their favorite teams as well as avail benefits of a credit card. Four years ago, ICICI Bank launched a co-branded credit card with Manchester United, a professional football club of England.

Speaking on the collaboration, Mr. Sudipta Roy, Head – Unsecured Assets, ICICI Bank said, “ICICI Bank has a rich legacy of pioneering innovative, powerful and distinctive value propositions for its customers. We are delighted to collaborate with CSK to introduce a co-branded credit card, which offers the CSK fans a bouquet of exclusive privileges from the iconic team and distinct banking benefits from ICICI Bank. The card is a result of collaboration between two institutions and we expect that the CSK fans will like it.”

Mr. KS Viswanathan, CEO, Chennai Super Kings Cricket Limited said, “We are delighted to partner with ICICI Bank for the launch of a co-branded credit card. We are confident that this partnership will benefit our fans across the country and spread Yellove far and wide.”

Customers can apply for the ‘Chennai Super Kings ICICI Bank Credit Card’ by sending an SMS ‘KING’ to 5676766.

Exclusive experiences for CSK fans:

- Joining and renewal gift of 2000 reward points that can be redeemed against CSK merchandise

- Complimentary tickets to CSK matches during the playing season

- Monthly top spenders to get memorabilia autographed by key players

- Exclusive meet and greet session with select players

- An opportunity to attend a practice session of the team

- These are available to the qualifying top spenders of the card and will be in accordance with the prevailing COVID-19 regulations set forth by the tournament’s governing body.

Other key benefits:

- 10 reward points on all retail spends on the Chennai Super Kings match days (1 reward point = Rs 0.25)

- 2 reward points on all retail spends on other days

- Complimentary access to domestic airport lounges in India

- Exclusive discounts on ticket bookings on BookMyShow and Inox

- Exclusive offers on dining through the Bank’s ‘Culinary Treats’ programme

- 1% fuel surcharge waiver on HPCL fuel pumps

To know more, visit:

To read the terms & conditions of the card, visit: https://www.icicibank.com/managed-assets/docs/pdf/csk-t-c.pdf

For news and updates, visit www.icicibank.com and follow us on Twitter at www.twitter.com/ICICIBank

About ICICI Bank

ICICI Bank Ltd (BSE: ICICIBANK, NSE: ICICIBANK and NYSE:IBN) is a leading private sector bank in India. The Bank’s consolidated total assets stood at Rs 16,82,904 crore at December 31, 2021.

Certain statements in this release relating to a future period of time (including inter alia concerning our future business plans or growth prospects) are forward – looking statements intended to qualify for the ‘safe harbor’ under applicable securities laws including the US Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from those in such forward-looking statements.

These risks and uncertainties include, but are not limited to statutory and regulatory changes, international economic and business conditions; political or economic instability in the jurisdictions where we have operations, increase in non – performing loans, unanticipated changes in interest rates, foreign exchange rates, equity prices or other rates or prices, our growth and expansion in business, the adequacy of our allowance for credit losses, the actual growth in demand for banking products and services, investment income, cash flow projections, our exposure to market risks, changes in India’s sovereign rating, as well as other risks detailed in the reports fi led by us with the United States Securities and Exchange Commission.

Any forward looking statements contained herein are based on assumptions that we believe to be reasonable as of the date of this release. ICICI Bank undertakes no obligation to update forward – looking statements to reflect events or circumstances after the date thereof. Additional risks that could affect our future operating results are more fully described in our filings with the United States Securities and Exchange Commission. These filings are available at www.sec.gov